Imagine you’re baking a cake for a client. You’ve mixed the ingredients perfectly, creating an ideal batter. Yet, when it’s time to bake, your old oven fails to reach the necessary temperature. Despite your best efforts with alternate methods, the cake turns out too dry, leaving a dissatisfied client.

The issue? You lacked the proper tools.

In a similar vein, while banks have the capability to offer unparalleled customer experiences, outdated systems often impede their progress.

The global lending arena is undergoing swift changes, prompting banks and credit unions to reconsider their strategies to navigate both the challenges and prospects presented. Several contemporary trends, especially post-pandemic, are influencing how financial institutions capitalize on new lending opportunities. To truly thrive in this fiercely competitive environment, banks must equip themselves with the optimal loan origination system.

The Challenges of Digital Lending and the Case for Loan Origination Systems

The rise of digitalization raises the question: is the era of traditional banking coming to an end? As fintech firms increasingly dominate the financial landscape, traditional banks and credit unions grapple with maintaining relevance. McKinsey’s research reveals that 40% of consumers now rely on fintech platforms for regular financial tasks. Adding to this, Cornerstone Research highlights the daunting challenge of revenue decline for banks, particularly with the drop in net interest margins, a pivotal revenue source. To regain their footing and navigate these challenges, financial institutions must equip themselves with comprehensive loan origination systems.

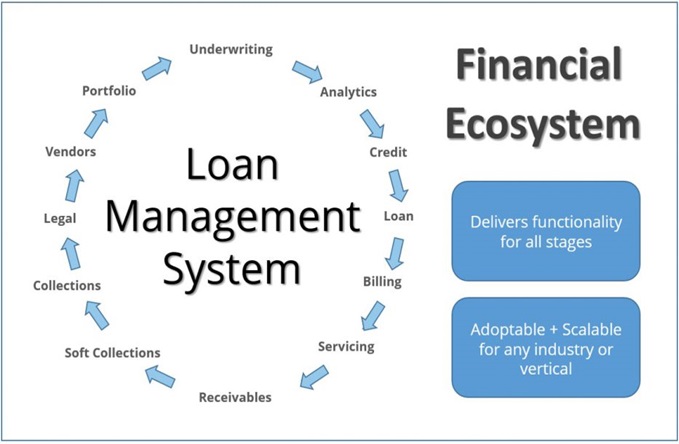

End-to-end Management of Lending Process with a Loan Origination System

While providing loans should be straightforward, outdated lending systems often complicate the process. In our rapidly digitalizing world, it’s vital for lenders to adopt digital loan origination systems to meet modern consumer demands.

Such a system oversees the entire lending journey, from the initial application to the final disbursement. By utilizing an all-encompassing loan origination system, financial institutions can smoothly onboard customers once they apply for a loan. This system streamlines various facets of the loan process, from credit checks and loan pricing to digital KYC verification and fund disbursal.

Catering to All Types of Loans with a Loan Origination System

People seek loans for various purposes, be it buying a home or car, expanding a business, or funding higher education. To cater to this diverse range of needs, financial institutions must have agile and adaptable lending systems that can accommodate everything from SME and commercial loans to retail and SBA loans.

In the absence of a robust loan origination system, lenders often rely on inefficient methods like emails, spreadsheets, and phone calls. Just as a single mistake can ruin a cake and require starting from scratch, human errors in the lending process can be costly for banks in both time and resources. This is where a state-of-the-art loan origination system comes into play. Such a system can provide:

- Faster loan processing times

- Enhanced data accuracy

- On-the-fly report creation

- Elevated customer satisfaction levels

- Enhanced loan monitoring and tracking

- Better quality control and regulatory compliance

Behind the Scenes of the Loan Origination Process

The loan origination process unfolds over a series of steps, seamlessly transitioning from one phase to the next. Here are the five critical stages:

- Loan Application: At this stage, the lender gathers the applicant’s details and assists them in filling out the loan application.

- Loan Processing: Here, the lender collects and verifies the information provided by the applicant.

- Underwriting: In this phase, the lender evaluates the risk associated with granting the loan to the applicant and then makes a decision.

- Disbursal: Once all the preceding steps are satisfactorily completed, the loan amount is finally disbursed to the borrower.

- Servicing: This ongoing phase encompasses all activities related to loan maintenance, such as sending payment reminders and ensuring timely repayments.

The 7 Must-have Capabilities of an Ideal Loan Origination System

Each institution has its distinct process requirements. With the evolving nature of business and process dynamics in the banking industry, it’s crucial to have a solution that’s both adaptive and resilient. When contemplating a loan origination system for your organization, ensure it has these indispensable attributes:

1. End-to-end automation of the lending process

Start by evaluating if the loan origination system offers a comprehensive automation feature. It should centrally manage the workflow right from lead generation, through to disbursal and subsequent servicing.

2. Single unified interface

A top-tier loan origination system should seamlessly integrate all functionalities related to the lending process. By doing so, it minimizes manual interventions and potential mistakes, ensuring a cohesive and standardized experience for customers. Imagine visiting a drive-through where you receive part of your order at the window and have to collect the rest inside – that’s an inconsistent experience! In the lending realm, uniformity in processes ensures smooth operations and satisfied customers.

3. Digitize manual and paper-heavy process

The system should have the capability to effortlessly transition manual, paper-driven procedures into a digital format. This shift not only streamlines operations but also significantly reduces the time taken and potential human errors.

4. Seamless integration with core banking systems

It’s pivotal for the loan origination system to flawlessly merge with core banking and other legacy systems, without the need for bespoke coding. Automation should be feasible for various processes, such as credit checks, managing leads, and screening against blacklists.

5. Automation and configurability of credit policy

Standardizing credit and deviation policies can often consume precious time for staff. Leveraging an automation engine grounded in business rules management can tackle recurring scenarios, allowing employees to direct their energies towards more complex tasks.

6. Handle compliance through proactive management

The ideal loan origination system should equip financial institutions to actively oversee compliance. It should frame processes to enhance transparency, traceability, and audit capabilities.

7. Accelerate deployments

In a swiftly changing market, speed is of the essence. The loan origination system should be agile enough to fit within your specific operational context and not just offer a one-size-fits-all solution. Utilizing a framework-centric strategy can truncate the deployment duration, granting a competitive edge with a quicker market launch.

The Right Loan Origination System Can Make All the Difference

Just as baking a flawless cake requires the best tools and expertise, efficient loan processing demands the perfect blend of cutting-edge technology and trusted partnerships. Debunking the old saying, with the right system, financial institutions can indeed “have their cake and eat it too!” In essence, with solutions like Newgen, financial institutions are equipped with the ideal technological framework and collaborative advantages. Newgen’s loan origination software is adept at eliminating operational gaps, harmonizing front and back-office functions, and refining the lending journey.

Comments